https://www.linkedin.com/posts/world-economic-forum_in-the-past-50-years-water-related-disasters-activity-6827598850388221952-12ov<iframe src=”https://www.linkedin.com/embed/feed/update/urn:li:ugcPost:6827598849901682688″ height=”671″ width=”504″ frameborder=”0″ allowfullscreen=”” title=”Publicação incorporada”></iframe>

ESG, climate change, emerging country, blind people and insurance, together with João Vinícius Carvalho (University of São Paulo) and Edimilson C. Lucas (Federal University of Sao Paulo), we put all in a paper is published (with Questionnaire, Data, Video, and Code, all open and available) in Journal of Environmental Management.

The insurance industry grows and develops by knowing more about the preferences of individual consumers of financial services dedicated to protecting their well-being. In parallel to this, in recent years even before the 2020 Coronavirus pandemic, insurance companies which act as risk managers and big institutional investors have been gradually taking into account environmental, social and governance (ESG) aspects in formulating their corporate strategies, especially due to the impact of climate change on community resilience. On the other hand, individual consumers usually make their decisions under ambiguous or uncertain conditions in terms of the risks involved.

These issues, taken together, are even more important when dealing with vulnerable populations, such as people with disabilities (PwD), and/or those who live in countries with a lack of infrastructure. Although the literature has documented various concerns about social protection for PwD, such as health insurance, retirement schemes, and even the job market, there is an important gap regarding this vulnerable public’s demands for insurance and other mechanisms for protecting their assets. There has especially been a lack of field experiments that provide information about the potential risks involved in order to determine these individuals’ perceptions, preferences and needs.

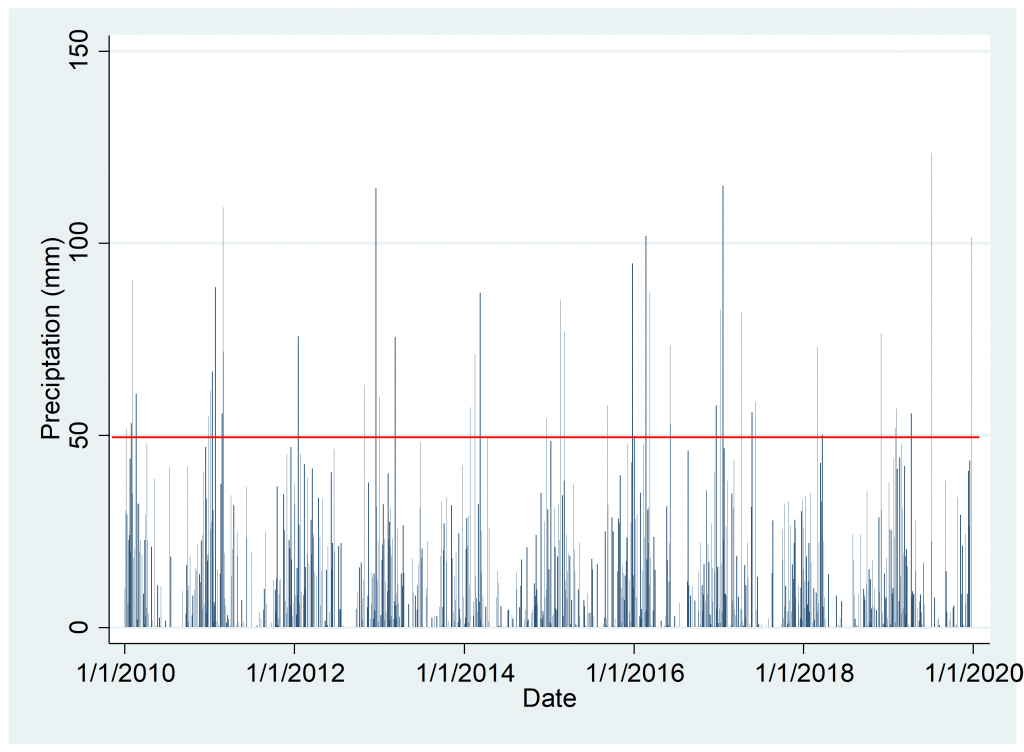

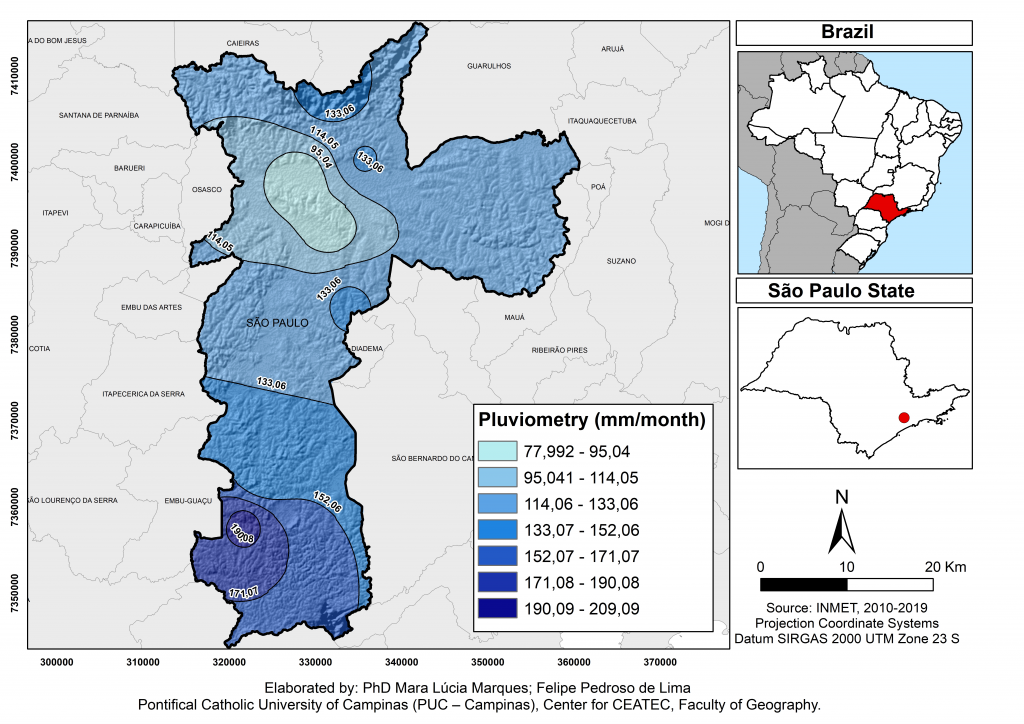

Over the past four decades, more than 9,000 natural disasters have caused over two million deaths and economic damage of roughly $ 2.5 trillion throughout the world. Floods and storms have been responsible for almost 80% of the total number of disasters, which have caused 55% of these deaths and 86% of these economic losses, most of which have not been covered by insurance. In this study, we are interested in assessing the effect of information on the propensity of heads of households to acquire home insurance against natural disasters, specifically floods. Our research design is based on a survey of over 500 individuals, including blind people (PwD) in the largest city in Latin America: São Paulo, Brazil.

The current literature includes various studies about the propensity of individuals to acquire flood insurance. However, this study differs from the others in at least three aspects. First, we have studied the effect of information on the propensity to acquire flood insurance, and we did this in the middle of a design which included an intervention with randomly selected individuals to diminish problems related to selection bias, and other sources of the empirical challenge of endogeneity.

Second, we included blind individuals, people who are vulnerable due to a physical deficiency, in line with related literature, in constructing public policies and/or guiding new financial products. Third, we provide evidence in terms of individual behavior in consuming financial products which are still not often encountered in the market, a central aspect to preventing crises. In addition, we provide evidence from an emerging economy, emphasizing that a large portion of the world population lives in developing countries, in which the proportion of people living under vulnerable conditions, such as PwD, is relatively accentuated.

Comentários